What's Declining & What's Not In The Permian

- Jun 19, 2023

- 6 min read

Updated: Jun 22, 2023

What's Going Down....

Crude + Condensate Productivity Per Well

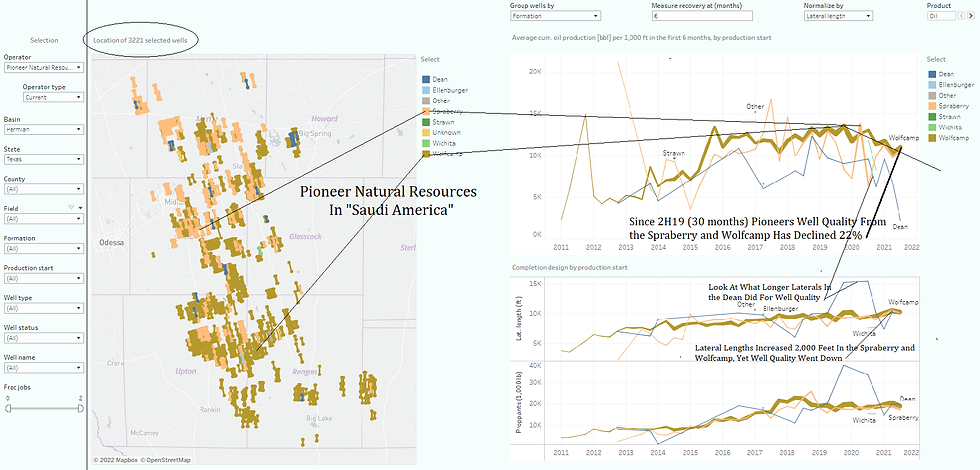

Initial well productivity, when normalized for lateral length, has been declining in core areas of both sub-basins in the Permian Basin since 2017. According to Novi Labs and Goehring and Rozencwajg Resource Investments, left, an eight (8) percent decline in 2022 alone.

This decline in productivity is occurring in spite of much longer laterals and more proppant loading per perforated foot. It is likely because of overdrilling and pressure depletion. It is NOT reversible short of expensive gas re-injection. The dookey about new frac technology, or re-frac'ing that will double US shale oil production is really stinky. Give us a break after 10 years, will 'ya? Please stop lying. I've read several people say Permian operators are now saving good locations for better prices and that is the dumbest thing imaginable.

These Permian wells don't start off slow, then pick up steam as they get older; those wells are absolutely gutted, maximum flow, then decline like throwing a rock off a roof.

Estimated ultimate recovery (EUR) per well is also dropping. Recovery rates of oil in place struggle to reach 10-12%.

Oil to Water Ratios

Total produced water production in the Permian Basin, end of 2022, was estimated to be 15.o MM BWPD, enough salt water to completely fill Lake Travis, north of Austin, Texas (1.2 MM acre feet) every 1 and one half years.

Oil/water ratios (OWR) in both sub-basins of the Permian have been steadily declining since the HZ tight oil play began in 2014.

OWR in the Midland Basin can often now average 5 BW: 1 BO and in the Delaware Basin 10 BW: 1 BO (Permian Basin Oil & Gas Magazine, Produced Water Society, DOE).

Above, Midland County OWR thru 2021 (Novi). It's gotten worse, not better.

As injection volumes and injection pressures go up, formations to put this produced water in are also declining, rapidly.

Groundwater supplies in arid West Texas, where frac source water comes from, is also declining. The percentage of produced water recycled for frac source water is pretty much the same as it was five years ago, something like 20% (Produced Water Society).

Drilled Uncompleted Wells (DUC's)

There are numerous reasons to call a DUC a DUC, even when its not. Most of those reasons have to do with the SEC 5 Year Proximity rule, 'booked' reserves and loan related debt to asset ratios.

The Permian has been carrying about a thousand DUC's since the get-go; there pretty much all dead DUC's. All those DUC's built between 2017 and 2020, then completed, are now gone. Thankfully, I hope, so is the confusion among analysts as to how DUC's have contributed to Permian Basin growth the past few years . DUC's have helped mask over the decline in well productivity and likely added to the Energy Inaccuracy Agency's ridiculous Permian well productivity per drilling rig metric.

Crude + Condensate As a Percentage of the Total Net Revenue Stream

Prior to 2020. many Permian HZ players (Pioneer, Devon, EOG, Diamondback, Conoco) based economic guidance, and remaining drilling locations within their acreage blocks on crude + condensate representing 70-75% of their revenue stream. Their investor presentations claimed 70% oil rates for the next 25 years. You can google that.

As gas to oil ratios (GOR) have increased across both sub-basins, associated gas volumes have skyrocketed and crude oil and condensate as a percentage of the well's net revenue stream to the 100% working interest has declined to 50%. Pioneer Resources, below, operating in the guts of the Delaware Basin, reports 50% oil now. Pioneer Natural Resources, the big boy in Saudi America, was just as bad before gas and NGL's tanked; its MBOPD is 1/2 its MBOEPD at 6:1 mcf/bo. PDP and PUD reserves touted by the tight oil sector years ago are grossly exaggerated; where are the impairments? The Wall Street Journal got onto that shit like white on rice.

Oil Quality

The "quality" of oil, if that is what you want to call it, from HZ tight wells in the Permian Basin, particularly the Delaware sub-basin, is declining. It's very light and getting lighter. This typically is more difficult to refine and a lot of Permian tight oil is being sold at a growing discount to West Texas Intermediate (Houston), Brent and Feteh in Dubai.

Sadly for America, once Permian tight oil production declines to US refinery absorption rates (4.8 MM BOPD) and oil exports cease out of necessity, LTO will be so light it won't be worth refining. We will have shot ourselves in both feet, and both knees.

Product Prices & Wells Economics

Look at the table below for the most current Waha spot prices for Permian Basin associated gas and NGL's. Inflationary D&C costs are down 4-5% the past year, maybe; OPEX, including produced water handling and disposal is going thru the roof, however.

The burden that 40,000 HZ wells in a hot, arid part of Texas puts on the electric grid is enormous; electricity costs per Kwh are to the moon. A lot of the "grid' in Texas is directed toward the Permian and takes away from other parts of Texas causing blackouts. They now plug entire drilling rigs into the West Texas grid, for God's sake.

Because of increasing water production economic limits are reached sooner than decline curve analysis suggests. Again, at $70 gross oil at the WH I place the net back price for oil approaching $20.

Overall IRR's have declined in the Permian Basin to low to mid single digits.

An investor can earn as much, or more, from bank certificates than it can owning working interest in a typical Permian Wolfcamp well. Enthusiasm for investment is definitely declining.

Equity (assets) to debt ratios are declining and traditional lenders have R U N N-O F T ('O Brother, Where For Out 'Thou). Forever.

The new scheme in town for raising money is bonds.

Rig Counts

Well economics suck in the Permian right now. Higher oil prices won't fix the problem, not when 50% of ones revenue stream and profit margins are based on associated gas prices and natural gas liquids prices. What the tight oil sector needs is much higher natural gas prices, the take away and LNG export facilities to then get that gas to Europe. If you wish to invest in the long term viability of that, help yourself. Not me. When solution gas driven shale oil containers deplete, so does associated gas. Besides, if you think this Permian gas can compete with Qatar gas, your not thinking straight.

Primo Drilling Inventory

We're approaching 41,000 HZ tight oil wells in the Permian Basin and 72% or more of all those wells lie in just six core counties in both sub-basins: Midland, Howard, 1/2 Glasscock, 1/2 Upton in the Midland Basin and Lea, Eddy and 1/2 Reeves and 1/2 Loving Counties in the Delaware Basin.

Over 80 % of those wells in those core counties are completed in one bench of the Lower Spraberry, three benches of the Bone Springs and two benches of the Wolfcamp. Look at rising GOR levels in the most heavily drilled county in the entire Permian Basin, by the biggest operator, Pioneer...Midland County. Its gassing out.

These tight oil fellas still claim they've got 20 years or more of Grade A, primo drilling locations. Not any more, not with 50% oil and 50% gas revenue streams.

If they do, how come todays wells, at $70 oil prices !! are declining in productivity, only generating single digit IRR's and have less 125% ROI's? Why is GOR going up and OWR going down?

To quote Billy Beene, if the Permian is such a big hitter, why isn't it hitting big? $70 is a GOOD price for oil.

ANALysts put so much importance on mergers and acquisitions as being an indication of good health in the Permian Basin; well, where are they?

The upside in a Permian HZ acquisition is drilling locations, not PDP wells that decline 17% every year and then take $100K to plug, abandon and decommission.

M&A has fallen off a cliff because the heart of the watermelon has been eaten, the good stuff pretty much drilled up. There is not much to buy.

Three times more wells than the existing 41,000? Good luck. I have no idea where the frac source water will come from, and where it will be disposed of.

US Domestic and Foreign Hydrocarbon Policies

We've got none.

Future Plans For Conservation, Prevention of Waste, Preservation of Bottom Hole Pressure & Increasing Recovery Rates of OIP

Nada, zero, zilch.

What's Going Up...

Permian Oil Exports To Foreign Countries

While the mighty Permian Basin is showing signs of pooping out, oil exports from the the US are nearing 5.0MM BOPD, up over 22% in the past 15 months.

85% of those exports come straight from the Permian HZ tight oil play, are put on a boat in Corpus, Houston, Port Arthur and sail away, never to be seen again.

Remember, when the Permian Wolfcamp can only spit out 250K BOE EUR's, that cost $14MM each, that's all she wrote for America. Stick a fork in us. Maybe China and the KSA will hep us out down the road, but I wouldn't count on it.

Hell yeah, we should.

One of the most underappreciated post I can think of.