Alpine Low

- Jun 8, 2023

- 3 min read

Balmorhea area of West Texas. God does big work in the evening in West Texas.

Apache's Alpine High boondoggle.

I. INTRODUCTION 1. Apache is an oil exploration and production company whose single most important asset during the Class Period was an oil and gas field in the Texas panhandle called “Alpine High.” For three years, Defendants touted Alpine High as a “transformational discovery” and “world class resource play” with immense production capabilities, including “conservative” estimates of over three billion barrels of oil and significant amounts of “really rich gas.”1 Defendants supported their claims by highlighting examples of “strong well results” and “successful oil tests” that were purportedly representative of Alpine High’s “2,000 to more than 3,000 future drilling locations,” which would “deliver incredible value to Apache and its shareholders for many, many years to come.” Analysts and industry media lauded this “massive shale discovery,” emphasizing that Alpine High’s “compelling economics” represented Apache’s “largest catalyst opportunity” for the coming years and put Apache “back in the game” after a “rough time keeping up with competitors.” Fueled by Defendants’ assurances, Apache’s stock price soared, reaching a Class Period high of $69.00 on December 12, 2016. The Individual Defendants took full advantage, reaping more than $75 million in Alpine High-linked compensation during the Class Period.

2. Unbeknownst to investors, Defendants’ statements were false. In reality, Apache’s own production data and analyses of the Alpine High play never supported Defendants’ public representations. As Apache was ultimately forced to admit, Alpine High was virtually barren.

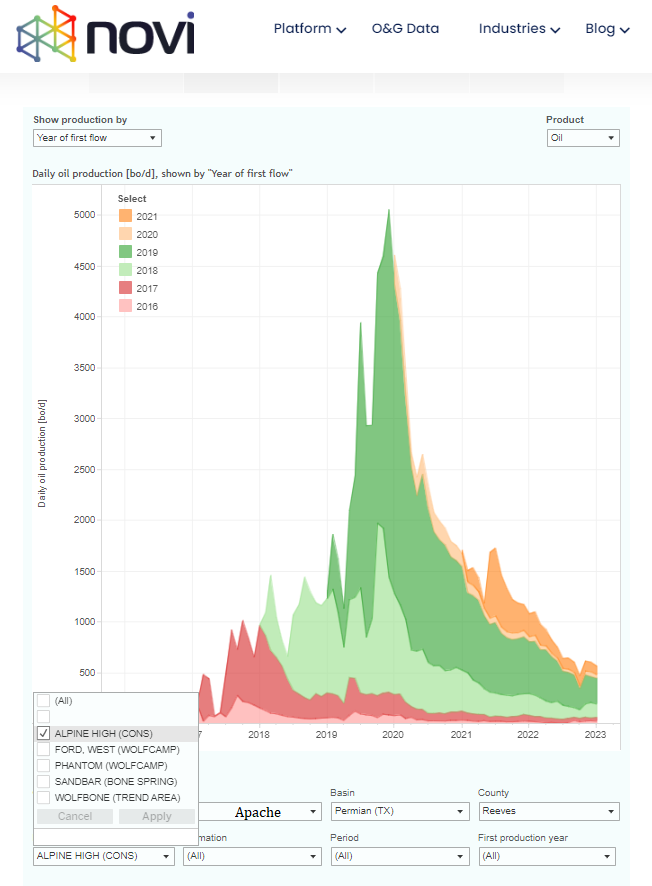

High, medium and low Apache type curves for Alpine High, before they bailed.

Apache got shit for all this Alpine stuff from the get go. Wells could not be drilled to follow even low-end type curves. By the time it abandoned drilling on these Alpine High blocks, Apache had lost over 90% of its share value totalling $24 billion dollars. Shareholders that bought into the original bullshit filed suit. The defendants have filed several motions to dismiss, all motions denied, the latest being September 2022. For the record, it is Securities and Exchange Commission suit based on allegations of fraud.

Click to read. Its long but actually kind of fun.

The Woodford out there in Alpine Low got a little flurry of activity again last year with $5 natty; it didn't last long. Remember, its dry, dry, dry gas. Apache liked to tout its reserve potential in SW Reeves County in BOE, but liquids only represented 2% of the revenue stream. Explain the intent of that, please.

Those guys need to be strung up for this shit. This same outfit did the exact same thing in the Williston Basin of eastern Montana, drove their stock price up, then bailed. Lots of people lost money.

Alpine temporary high, CEO Bonanza !

I hate lying.

Bad estimates hurt people and are about to hurt my country.

Before I get called communist, biased, cynical, a liberal, anti-oil, anti-Texas old bastard... remember, I was an oil and gas producer in Texas for over a half century. And, I can write shit like this all day long about the US tight oil and tight gas sector. I'm talking all day long.

Apache can eat fish heads. They can dine with Exxon and discuss how new frac technology will help Exxon make more oil, and less gas, in Eddy County. In fact, we can have a big party over fried fish heads and cold beer and I can invite just about every CEO in the tight oil and tight gas business to attend.

Don't be mad at me. I am just a lone voice in a big room full of lies. I love my country. I want all of our kids to be ready for some bad shit coming down the road. I've got the cajones to speak out.

Mike

Comments