Cartoon Of the Week

- Nate Beeler; Editorial Comments By Oily Stuff

- Oct 16, 2019

- 1 min read

_________________________________________________________

The American "conventional" oil industry, including integrated up and downstream companies, typically pays around $25 billion per year in income tax, rentals and royalty payments to the federal government (American Petroleum Institute; google it). Even junky ass stripper well operators, like me, have to pay federal income tax on production revenue. I do, proudly.

Not the United States shale oil industry, however. Large public independents with operations specific to unconventional shale have NEVER paid federal incomes taxes since they came out of the chute a decade ago. Why? Well, you have to make money to pay taxes.

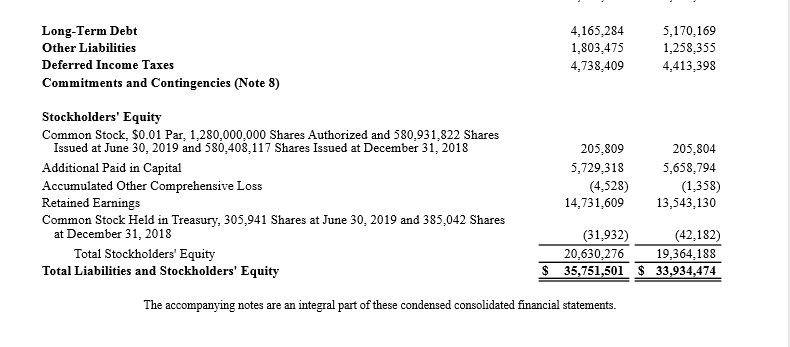

Below is the 2Q19Q balance sheet from an SEC filing for the largest pure shale oil corporation in the United States; it has "deferred" federal income taxes of $4,738,409,000, that's with a 'B.' This corporation actually made over $800MM in profits this quarter...but its loses are so great, for so long, it will not have to pay federal incomes taxes for a very long time.

We can look at SEC filings until the cows come home and we'll see the same thing over and over again; almost all public shale oil companies in the US have enormous tax loss carry forwards from operations. It will be decades before these companies have to pay federal income taxes, if ever.

________________________________________________

My apologies to Mr. Beeler; he'd understand, I am sure.

Comments